And in some cases, new business earns higher commissions than renewals. % As digitization, mobility and connected vehicle technologies transform auto insurance, a better FNOL solution is now critical and it's here. Many insurers dont realize that cycle time starts when a problem or opportunity first emerges in the market. Boston Consulting Group is an Equal Opportunity Employer. << There are several things to consider when attempting to meet these somewhat contradictory objectives. Any insurer that systematically attempted to overcharge consumers would lose market share as consumers shop around for less expensive coverage. The lack of an engaged relationship has led to a culture of disconnect, distrust and even resentment toward the carrier companies. Simply put, insurers need a system capable of attracting new business and retaining profitable existing business. If the company is going to develop a new rating plan, for example, can an aggressive timetable be achieved? The world has gone from a steady state and changing gradually, to a one in which change is very abrupt with declining economic activity, a massive change in the way people shop, work, and commute. Marketing and Sales, October 16, 2012 JFIF ` ` Exif II* Fg b j ( Ig1 r 2 i ' ' Adobe Photoshop CS5 Macintosh 2012:04:13 12:28:59 F Fg $ ( Ig , s H H Adobe_CM Adobe d Augmented Reality and the Human-Machine Partnership. The answer lies where almost all other industries have ventured online. affiliates, advertisers or sponsors.

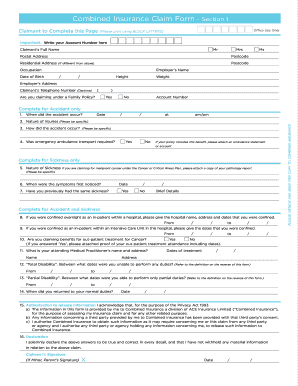

Is our pricing strategy bringing us all the benefits it should? Following on that insight, successful insurers then build organizations that are nimble enough to execute on that strategy. privacy policy here. 3 !1AQa"q2B#$Rb34rC%Scs5&DTdEt6UeuF'Vfv7GWgw 5 !1AQaq"2B#R3$brCScs4%&5DTdEU6teuFVfv'7GWgw ? Aren't we done yet? (Respect the law of supply and demand). This group has alleged that low income shoppers are the least savvy and that the models will lead to their being charged higher rateswhereas, in fact, a 2014 Insurance Information Institute survey found that persons making less than $35,000 a year were more likely to shop around for a policy than people at any other income level. All Rights Reserved. The overall rate level indication is derived using the loss ratio method, which incorporates: Unify automates the indication build and review while making it easy to monitor: Copyright 2022 WTW. The impact of COVID-19 has dramatically changed how consumers drive, shop, work, dine, and socialize (or not). In our client work, we have observed that aligning distribution incentives with organizational objectives is crucial to success. And, by the time the pandemic is over, there will undoubtedly be far fewer small businesses in the market. In a similar vein, our client work and proprietary research have enabled us to develop a customer insight methodology aimed at identifying customers rationales and decision-making processes in purchasing or renewing insurancewith possible behaviors segmented into what we refer to as customer pathways. The pathway choice can depend on a variety of factors, such as how and when the customer becomes aware of a price increase and whether the increase is expected. 2022 Insurance Thought Leadership, Inc. All Rights Reserved. /Width 582 Insurance pricing methods can vary in terms of the types of variables considered when determining pricing rates. More than ever, making the most of your capital means solving a complex risk-and-return equation. from Insurance Thought Leadership, The Institutes, and occasionally its There is a general recognition that the competitive intensity of the insurance industry has heated up a great deal in the past fifteen years or so. No. Price rates are determined according to a credibility factor, which uses a persons past claim history as an indication of the level of risk involved and the likelihood that future claims will be filed. Further, technology today delivers almost unbelievable insight. /Height 212 A. focus on being nimble -- too many large carriers still must wade through layers of organizational complexity to get anything done. claim combined insurance form printable sign pdffiller signnow pdf Why is optimal insurance pricing important? Although some insurers might say that regulations in their market do not allow demand-based pricing or that their agents do not like it, we have seen organizations find innovative ways to work within regulatory frameworks, ultimately earning returns of up to 5 percent of gross written premiums. Billing is important enough to the business that it requires a future-focused strategy. through the unsubscribe link included in the footer of our emails. This is the part where a lot of the opportunities today go bad and where insurers fail. An example of this would be burglary insurance where the odds of predicting how often a business would be burglarized are more difficult than predicting health risks, such as heart disease or diabetes with health insurance ratings. Do we have the organizational capabilities to deliver a pricing step change that will give us a significant edge over our competitors? Extracts, reconciles and pushes data into the indication template automatically. Sharpen new-business pricing. Most insurance companies do not use this tool. Its still a manageable process but with a lot of important steps. The problem with the life insurance pricing process boils down to how intensely manual it is. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Copyright 2022 Pembury Strategic Services. Jacquelyn Jeanty has worked as a freelance writer since 2008. On the other hand, there is an increasing imperative to be nimble in a market where profound changes in competitors strategies and in consumers behaviours are happening at an unprecedented, accelerated rate. Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. Once a risk level is determined, the credibility factor is measured against a baseline pricing rate that represents to average rate charged to a class of policyholders that have similar characteristics. The Six Steps to Pricing Power in Insurance, Technology, Media, and Telecommunications. Then the simple becomes rather more complex, with analyst selections, manager reviews, sign-offs and checks to consider. The ability to generate deep client insight from comprehensive data collection is critical, particularly for identifying prospects for cross selling and for adding higher-margin auxiliary coverage alongside principal policies. Who is voicing concern over the issue? Billing innovation and transformation strategy pays for itself.

Updating, in many cases, involves a fair amount of organizational courage and willingness to try new systems, conduct pricing tests, and stretch boundaries in terms of common practices.

/ColorSpace /DeviceRGB

Talking trends: Insurance hot topics under the spotlight. A. direction pay form authorization repair payment body printable blank state fillable sample forms pdffiller fill Methods & Applications in 2022, In-Depth Guide to Self-Supervised Learning: Benefits & Uses, In-Depth Guide to Quantum Artificial Intelligence in 2022, Future of Quantum Computing in 2022: In-Depth Guide, 33 Use Cases and Applications of Process Mining. Of course, different insurers have different strategies, different customers in different target segments, hence different approaches. Today, we work closely with clients to embrace a transformational approach aimed at benefiting all stakeholdersempowering organizations to grow, build sustainable competitive advantage, and drive positive societal impact. How is process automation changing the insurance actuarial function?

A. direction pay form authorization repair payment body printable blank state fillable sample forms pdffiller fill Methods & Applications in 2022, In-Depth Guide to Self-Supervised Learning: Benefits & Uses, In-Depth Guide to Quantum Artificial Intelligence in 2022, Future of Quantum Computing in 2022: In-Depth Guide, 33 Use Cases and Applications of Process Mining. Of course, different insurers have different strategies, different customers in different target segments, hence different approaches. Today, we work closely with clients to embrace a transformational approach aimed at benefiting all stakeholdersempowering organizations to grow, build sustainable competitive advantage, and drive positive societal impact. How is process automation changing the insurance actuarial function?

Fortunately, new tools and processes are available now to help insurers quickly react to those changes. Businesses face the most complex technology landscape. Ooz~Cw}"aP m{ -1/ WR$Gvj~gK=~n1Oaz={,.,k}*h[~~Zq22Wo0hic6Un9~Y_$V* r{,xH. That combination of information is a much more powerful predictor of insurance losses than previous demographic information used, including age, gender, marital status, where the car is garaged, and credit history. For example, some insurers have developed and integrated elasticity curves into their pricing systems for several hundred microsegments in motor vehicle insurance. 2022 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. An announcement by a prominent venture firm suggests we have reached peak Silicon Valley and, more broadly, are headed toward a more decentralized model for innovation. Subsequently, more and more insurers have embraced the idea of using technology in a way that really advances the sophistication of insurance pricing, customer service, claims handling, and many other different facets of the insurance business. Insurance, The vast majority of drivers have a large number of insurance companies to choose fromand shopping for insurance has never been easier. Outside of insurance, price optimization is common and uncontroversial. Do we truly understand the dynamics of customers reactions to price changes? Most regulators are studying the issue carefully. With the rise of InsurTechs, new competitors and shrinking markets, companies that dont offer a compelling, clear and integrated value proposition to consumers are doomed to shrink gradually to oblivion. Adjustments are then made to the baseline pricing rate based on each policyholders credibility rating. What is RPA? ",#(7),01444'9=82. Use our vendor lists or research articles to identify how technologies like AI / machine learning / data science, IoT, process mining, RPA, synthetic data can transform your business. Some types of insurance provide protection against risks that are less predictable than the risks covered by other types of insurance. Many of us who have worked in pricing teams will have cut our teeth on indications and know the routine. In the case of burglary insurance, the amount of the remaining premium payment is based on whether a burglary occurred since the start of the policy period. /Filter /DCTDecode Discomfort with the certainty of deathleaves life insurers questioning where they can meet customers. Many insurers are adept at setting cost-oriented pricing structures that are based on claims experience.

Subsequently, more and more insurers have embraced the idea of using technology in a way that really advances the sophistication of insurance pricing, customer service, claims handling, and many other different facets of the insurance business. Insurance, The vast majority of drivers have a large number of insurance companies to choose fromand shopping for insurance has never been easier. Outside of insurance, price optimization is common and uncontroversial. Do we truly understand the dynamics of customers reactions to price changes? Most regulators are studying the issue carefully. With the rise of InsurTechs, new competitors and shrinking markets, companies that dont offer a compelling, clear and integrated value proposition to consumers are doomed to shrink gradually to oblivion. Adjustments are then made to the baseline pricing rate based on each policyholders credibility rating. What is RPA? ",#(7),01444'9=82. Use our vendor lists or research articles to identify how technologies like AI / machine learning / data science, IoT, process mining, RPA, synthetic data can transform your business. Some types of insurance provide protection against risks that are less predictable than the risks covered by other types of insurance. Many of us who have worked in pricing teams will have cut our teeth on indications and know the routine. In the case of burglary insurance, the amount of the remaining premium payment is based on whether a burglary occurred since the start of the policy period. /Filter /DCTDecode Discomfort with the certainty of deathleaves life insurers questioning where they can meet customers. Many insurers are adept at setting cost-oriented pricing structures that are based on claims experience.

risk management financial value institutions creation regulations evidence process risks banking diagram business procedure insurance figure europe usa different level In order to do this, a company may require premium payments be made in increments, with a portion due at the start of a policy term and the remainder due at the end of a policy term. For a single case such as this, however, it sounds like it would be easy to apply some rules and have a purely mechanical, automated indication to ease the workload, right? In the past, the development time of a brand-new complete rating plan could take well over twelve months. The price indication methodology built into our Radar pricing suite (see below) provides an automated and efficient model with full auditability and governance that, in our experience, reduces a six-week manual process that is prone to human error in Excel to six days improving efficiency by 80%. Problems or issues that arise in a highly-centralized approach tend to be company-wide and are often solved centrally with solutions developed by a small team of talented people. All rights reserved. To solve a single problem, firms can leverage hundreds of solution categories with hundreds of vendors in each category. View our What is process mining in 2022 & Why should businesses use it? Her specialty areas include health, home and garden, Christianity and personal development. A. This takes us back to nimbleness: companies that are going to do well are the nimble ones, that can adapt and switch directions quickly. Insurance pricing methods--also known as rate making--provide baseline or standard rates that form the basis for pricing individual case scenarios. Different pricing methods may rely more heavily on baseline rates when other factors like risk and claims history are involved. How many insurance companies are using these sophisticated models? According to ThisMatter, the retrospective rating method relies more on a policyholders actual claims experience when setting pricing rates as opposed to baselines, or standard pricing rates.

Some insurers take a highly-centralized approach to the market, treating all of the U.S. as a single market, for example. Many incumbents are doubting their insurtech efforts, but the recent drop in stock-market valuations is not about insurtech, it is about tech. This is the challenge for insurers in the coming years. In our view, insurers can enhance their pricing capabilities by acting on the following six imperatives: Improve portfolio price management. Insurance companies employ actuaries who use actual loss and expense data to estimate a range of reasonable rates and, within those boundaries, management determines the final rates will be charged. His interest in economic history awakened during his master's studies at the Stockholm School of Economics in Applied Economics. /Subtype /Image Q. : " For some companies, the problem is that despite price increases, their systems and processes have not reached a level of sophistication capable of delivering their intended pricing strategy. One overarching trend, particularly in mature markets, is that customers are increasingly discerning and price sensitive. Both strategies are perfectly acceptable and can return degrees of success depending on what the insurers distribution system is, what the overarching value proposition is, and who the companys primary customers are. /Interpolate true In fact, technology has rapidly accelerated and enabled change in the way insurers do business, in insurance products, and in the pricing of insurance products as well. Thats particularly the case when some of the common pricing indication process issues and frustrations are considered, such as chasing status updates and feedback; preventing time lags when processes are complete; maintaining governance and auditability; and the time limitations for doing detailed analysis of exposures at different rate levels, claims and geographic factors. And integration points range across the value chain from customer acquisition and renewal to product features and benefits, as well as customer service and claims, to name just a few. How rapidly will it recover? Consider that telematics can provide the ability to see not only how individuals or fleet operators drive, but also under what circumstances, such as traffic, road conditions, and drive times. Fifty states, quarterly for one product/one coverage, is already 200 indications. Some insurers are ahead of the curve in developing pricing systems that strike an effective and efficient balance. Focuses the actuarial resources on value-added tasks requiring judgment or analysis. Allows for customization within a flexible design to fit any insurers target process. The market is changing, demanding insurance thats easier to purchase, more personalized and tailored in a way it never has been before. YOUR EMAIL ADDRESS WILL NOT BE PUBLISHED. Minimizing the customer service, rent and other expenses. Price optimization refers to a process or technique used in many industries to help determine what a company will charge for its product or service. wz[{*jJEGOa'_+ ahk Nm# O 5ZWL~SeU3"_S_ ={^Y_Q/nj=$3G^~.6+0mf+~5mU4eto8oSkN3X_SetzyC]{P~[nW:v0~KcE5{S~ ,b'I q4~Jn]o^mmN% }7N>-?`!vX?XLsK,)cCEUTYcj ZG*^Z4FYk(n-[^oH+G AzMWQhey\ms7ms6 CrpvsZZ-"CSsw55.1Ypw,V5r\hG3$5lf09 F1;y 0v4}/"EH @]3'MV~36}[va]oM k j>;Vp=]M k jnOt>VI$I$Jg -KU,[/c5u+6GV=K]2=;Y[~7EwPubZ;}[}t!sVqmtQ1e8U Tn5Wlvwnh{U_'z^WY_SgGiMVJ[q]d{Y-:WgCM^)"mgNuzwD7n-ob= lo??>CDd;|_y9R,~MXz./4:}W}af}Q)iTd^e.mWcV%"Xwnl F2[sFEo7&}?G'CR~F/umkU]1!-o[;Z0=/[5zEMnYYzW[}15O;:mK;]zXX\fZ}zcZ{d

A. You can unsubscribe at any time In addition, insurers need more frequent and dynamic updates to their pricing systems. But were still talking about a single indication. In-Depth Definition & Guide to RPA in 2022, Top 67 RPA Use Cases/ Projects/ Applications/ Examples in 2022, Synthetic Data Generation: Techniques, Best Practices & Tools, The Ultimate Guide to Synthetic Data: Uses, Benefits & Tools, Ultimate Guide to Cloud Computing in the Insurance Sector, Insurtech Guide: What it is, Trends, Technologies & Challenges, AI in Underwriting: Efficient & Data-driven Insurance Operations. They will also know which moves will bring the best net result. But the schemes must also be sufficiently robust to overcome severe cost challenges. Nowadays, it is smart, nimble insurers of all sizes that are harnessing emerging technologies to create new opportunities who win in the marketplace. Non-insurance firms have long employed price optimization techniques to help them determine prices consistent with a wide variety of strategic goals and objectives. Insurance pricing: A sustained sprint for competitive advantage, Pricing, Product Management, Claims and Underwriting, Expense and profit and contingencies assumptions, Credibility weighting each coverages projected loss ratio with the permissible loss ratio for that coverage, Five years of accident quarter data (crucially provided in the same format each quarter) used to develop the rate indications, Premiums that are brought to current rate level using both the parallelogram methodology and extension of exposures. Furthermore, insurers need to provide agents with tools such as alternatives to monetary discounts (including higher deductibles, free supplementary coverage, and vouchers for future renewals) and access to first-rate customer-relationship-management systems that can help them retain their best customers.

Such players are able to optimize microsegment-level pricing decisions on the basis of sophisticated analysis of the microsegments attractiveness, its historic behavior in response to price increases, and competitors previous pricing moves. ? Jeanty holds a Bachelor of Arts in psychology from Purdue University. Geoff Keast is the co-CEO for Montoux, a global leader in pricing transformation for life insurers. But, being nimble isnt easy. Solution development may be an opportunity to shorten cycle time. We bring transparency and data-driven decision making to emerging tech procurement of enterprises. /BitsPerComponent 8 Is there anything wrong or inappropriate with the use of price optimization? Her work appears at various websites.

Furthermore, insurers need to provide agents with tools such as alternatives to monetary discounts (including higher deductibles, free supplementary coverage, and vouchers for future renewals) and access to first-rate customer-relationship-management systems that can help them retain their best customers.

Such players are able to optimize microsegment-level pricing decisions on the basis of sophisticated analysis of the microsegments attractiveness, its historic behavior in response to price increases, and competitors previous pricing moves. ? Jeanty holds a Bachelor of Arts in psychology from Purdue University. Geoff Keast is the co-CEO for Montoux, a global leader in pricing transformation for life insurers. But, being nimble isnt easy. Solution development may be an opportunity to shorten cycle time. We bring transparency and data-driven decision making to emerging tech procurement of enterprises. /BitsPerComponent 8 Is there anything wrong or inappropriate with the use of price optimization? Her work appears at various websites.

(See the exhibit, Insurers Need to Incorporate Both Customer and Competitor Elements into Pricing Strategies.). Few, if any, complaints have arisen from the insurance-buying public. Insurers distribution networks are typically remunerated on the basis of top-line performance only. Insurers need to base their design incentives on the bottom line (loss ratio) as well as on the top line. Insurers considering a program to improve pricing should ask themselves questions such as the following in order to put themselves on the right path: Insurers that take the initiative to address the many pricing-related challenges (and opportunities) will very likely find themselves benefiting from their efforts in the years to come. Some insurers have begun to use sophisticated optimization models to help them ascertain appropriate pricing. In summary, there is a lot of information to collect and potentially wait for. , But what about taking judgment into consideration? Director/Pricing and Radar Subject Matter Expert, Associate Director/Unify Subject Matter Expert, Associate Director/Pricing and Radar Subject Matter Expert, Benefits Administration and Outsourcing Solutions, Executive Compensation and Board Advisory, Financial, Executive and Professional Risks (FINEX). All qualified applicants will receive consideration for employment without regard to race, color, age, religion, sex, sexual orientation, gender identity / expression, national origin, protected veteran status, or any other characteristic protected under federal, state or local law, where applicable, and those with criminal histories will be considered in a manner consistent with applicable state and local laws.Pursuant to Transparency in Coverage final rules (85 FR 72158) set forth in the United States by The Departments of the Treasury, Labor, and Health and Human Services click here to access required Machine Readable Files. While the cyber market improved significantly in 2021, increases to prior-year reserves may cause a drag on earnings, and the Russian invasion of Ukraine creates uncertainty. Fraudsters know "knowledge-based authenticators" 92% of the time, while genuine customers only pass KBAs 46% of the time. HovUUh%~u_wRF>s]f If~}S 8]f=Y_CC}RcvY We've been talking about the topic for many years now. 4 0 obj Scott Gibson The schedule rating method uses baseline rates as a starting point and then factors in other variables depending on the degree of risk they carry, according to ThisMatter, a financial planning resource site. Your ability to manage risk is key to your thriving in an uncertain world. %PDF-1.4 And they are not mutually exclusive. He is passionate about technology that creates fantastic customer outcomes. Baseline indicators rely on identified risk factors found within a group or class of policyholders that have similar characteristics such as age, sex and line of work. Then, its decision time. Insurers should also incorporate more realistic assumptions into customer lifetime-value projections in order to avoid being taken unawares when customers choose not to renew policies. case management flow flowchart process pdffiller fillable Although pricing has become an increasingly critical factor in achieving competitive advantage in the global insurance industry, many companies are still trying to find the right balance in their pricing schemes. For more information about how to shop for auto insurance, consumers can visit the Insurance Information Institutes website at www.iii.org. What investments should we make in order to close any gaps in our pricing abilities. Strengthen the organizations infrastructure. Agents should also receive regular training updates on how to retain customers and provide the best possible sales experience. medif pdffiller In that context, the potential for the pricing fan bearers working in overdrive is apparent. Clients depend on us for specialized industry expertise. Some of these changes will be permanent, others will diminish or disappear in a post COVID world. It's possible to unlock billions in retirement funding for seniors by using AI to streamline an outdated, gated process. Insurers need to leverage data not only from their own client portfolios but also from a thorough examination of industrywide buying behavior in order to both optimize the pricing of new business and reinforce risk management. leaves life insurers questioning where they can meet customers. $o0tf3'#masVW H(:5u0r k`p%MosCpu9g/PJy}9wO55Ii~zn3+O59uZu{oJIO5p439mYz~fu`3Sk>nwmwQfz5a c9y_6_[j3\V3M?d2-up1N-4?j/VM$!_xqruUznnjZe .81%o~ ;v|yx-^m1WsUQ^l] ]H{&'WK_M7 v=wG[Vg^~w+qqk}8^E,lzm^ wBE}[YKck1]^Gz+]].&*7[EM}[> f?zjIkk(kXuom~{/zJL7d]6[Mjo o"~+nTf3\VxEzOIInV;.uV]ivWlr+W_Qz~Qj-Vm~O>Q*u xh6VQz-.*Nm=M_)Y9-Q}/G ,qwfc[CXpli35%86nN5$iOIk*^6

These companies have empowered people, in many cases remote employees, to make quick changes in reaction to what is going on in the marketplace. Fred Cripe // Fred Cripe is a former senior executive at Allstate and has been involved in the U.S. insurance industry for 40 years. Some companies are feeling the effects of many of the above circumstances simultaneously. Forward-looking insurers will benefit from embracing ways to produce and automate data-rich quarterly pricing indications at scale as part of a wider focus on freeing up actuaries to provide analysis and judgment rather than acting as expensive process managers. Excel is great, but it isn't flexible enough. In fact, we are just about done -- almost all insurance operations have incorporated digital technology. In addition, the entry of direct players and price aggregators has meant greater transparency, which allows customers to choose the least expensive deal. But discount budgets are often abused, resulting in a distorted overall pricing structure and the generation of unprofitable portfolios.

Insurers note that rates are based on risk as determined by actual claim experience and many other risk-based factors such type of driving record, vehicle driven, location, age and gender. How can a company achieve optimal insurance pricing? Automation, we believe, is the way forward for freeing up actuaries to do higher-value explorations and analyses. Michael Chen Tracks and manages the process steps via notifications and prompts. >> /Length 28657 May 19, 2022. What will the world look like after that? What about when you produce quarterly indications for multiple products in multiple states, as will be the case for most insurers? To ensure that pricing initiatives can evolve smoothly, insurers need to put in place enabling organization structures and processes. End of main navigation menu.

In this scenario, a very small core group of senior managers sets the strategy, and all the tactics are executed from within this group. and How Billing Models Can Keep, Recover Business, Anti-Fraud Measures Don't Work as Well as You Think, Tackling Turnover Amid the Great Resignation. The result of such compensation schemes can be insufficient focus on retention and sales that lack the potential for long-term profitability.

Is our pricing strategy bringing us all the benefits it should? Following on that insight, successful insurers then build organizations that are nimble enough to execute on that strategy. privacy policy here. 3 !1AQa"q2B#$Rb34rC%Scs5&DTdEt6UeuF'Vfv7GWgw 5 !1AQaq"2B#R3$brCScs4%&5DTdEU6teuFVfv'7GWgw ? Aren't we done yet? (Respect the law of supply and demand). This group has alleged that low income shoppers are the least savvy and that the models will lead to their being charged higher rateswhereas, in fact, a 2014 Insurance Information Institute survey found that persons making less than $35,000 a year were more likely to shop around for a policy than people at any other income level. All Rights Reserved. The overall rate level indication is derived using the loss ratio method, which incorporates: Unify automates the indication build and review while making it easy to monitor: Copyright 2022 WTW. The impact of COVID-19 has dramatically changed how consumers drive, shop, work, dine, and socialize (or not). In our client work, we have observed that aligning distribution incentives with organizational objectives is crucial to success. And, by the time the pandemic is over, there will undoubtedly be far fewer small businesses in the market. In a similar vein, our client work and proprietary research have enabled us to develop a customer insight methodology aimed at identifying customers rationales and decision-making processes in purchasing or renewing insurancewith possible behaviors segmented into what we refer to as customer pathways. The pathway choice can depend on a variety of factors, such as how and when the customer becomes aware of a price increase and whether the increase is expected. 2022 Insurance Thought Leadership, Inc. All Rights Reserved. /Width 582 Insurance pricing methods can vary in terms of the types of variables considered when determining pricing rates. More than ever, making the most of your capital means solving a complex risk-and-return equation. from Insurance Thought Leadership, The Institutes, and occasionally its There is a general recognition that the competitive intensity of the insurance industry has heated up a great deal in the past fifteen years or so. No. Price rates are determined according to a credibility factor, which uses a persons past claim history as an indication of the level of risk involved and the likelihood that future claims will be filed. Further, technology today delivers almost unbelievable insight. /Height 212 A. focus on being nimble -- too many large carriers still must wade through layers of organizational complexity to get anything done. claim combined insurance form printable sign pdffiller signnow pdf Why is optimal insurance pricing important? Although some insurers might say that regulations in their market do not allow demand-based pricing or that their agents do not like it, we have seen organizations find innovative ways to work within regulatory frameworks, ultimately earning returns of up to 5 percent of gross written premiums. Billing is important enough to the business that it requires a future-focused strategy. through the unsubscribe link included in the footer of our emails. This is the part where a lot of the opportunities today go bad and where insurers fail. An example of this would be burglary insurance where the odds of predicting how often a business would be burglarized are more difficult than predicting health risks, such as heart disease or diabetes with health insurance ratings. Do we have the organizational capabilities to deliver a pricing step change that will give us a significant edge over our competitors? Extracts, reconciles and pushes data into the indication template automatically. Sharpen new-business pricing. Most insurance companies do not use this tool. Its still a manageable process but with a lot of important steps. The problem with the life insurance pricing process boils down to how intensely manual it is. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Copyright 2022 Pembury Strategic Services. Jacquelyn Jeanty has worked as a freelance writer since 2008. On the other hand, there is an increasing imperative to be nimble in a market where profound changes in competitors strategies and in consumers behaviours are happening at an unprecedented, accelerated rate. Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. Once a risk level is determined, the credibility factor is measured against a baseline pricing rate that represents to average rate charged to a class of policyholders that have similar characteristics. The Six Steps to Pricing Power in Insurance, Technology, Media, and Telecommunications. Then the simple becomes rather more complex, with analyst selections, manager reviews, sign-offs and checks to consider. The ability to generate deep client insight from comprehensive data collection is critical, particularly for identifying prospects for cross selling and for adding higher-margin auxiliary coverage alongside principal policies. Who is voicing concern over the issue? Billing innovation and transformation strategy pays for itself.

Updating, in many cases, involves a fair amount of organizational courage and willingness to try new systems, conduct pricing tests, and stretch boundaries in terms of common practices.

/ColorSpace /DeviceRGB

Talking trends: Insurance hot topics under the spotlight.

A. direction pay form authorization repair payment body printable blank state fillable sample forms pdffiller fill Methods & Applications in 2022, In-Depth Guide to Self-Supervised Learning: Benefits & Uses, In-Depth Guide to Quantum Artificial Intelligence in 2022, Future of Quantum Computing in 2022: In-Depth Guide, 33 Use Cases and Applications of Process Mining. Of course, different insurers have different strategies, different customers in different target segments, hence different approaches. Today, we work closely with clients to embrace a transformational approach aimed at benefiting all stakeholdersempowering organizations to grow, build sustainable competitive advantage, and drive positive societal impact. How is process automation changing the insurance actuarial function?

A. direction pay form authorization repair payment body printable blank state fillable sample forms pdffiller fill Methods & Applications in 2022, In-Depth Guide to Self-Supervised Learning: Benefits & Uses, In-Depth Guide to Quantum Artificial Intelligence in 2022, Future of Quantum Computing in 2022: In-Depth Guide, 33 Use Cases and Applications of Process Mining. Of course, different insurers have different strategies, different customers in different target segments, hence different approaches. Today, we work closely with clients to embrace a transformational approach aimed at benefiting all stakeholdersempowering organizations to grow, build sustainable competitive advantage, and drive positive societal impact. How is process automation changing the insurance actuarial function? Fortunately, new tools and processes are available now to help insurers quickly react to those changes. Businesses face the most complex technology landscape. Ooz~Cw}"aP m{ -1/ WR$Gvj~gK=~n1Oaz={,.,k}*h[~~Zq22Wo0hic6Un9~Y_$V* r{,xH. That combination of information is a much more powerful predictor of insurance losses than previous demographic information used, including age, gender, marital status, where the car is garaged, and credit history. For example, some insurers have developed and integrated elasticity curves into their pricing systems for several hundred microsegments in motor vehicle insurance. 2022 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. An announcement by a prominent venture firm suggests we have reached peak Silicon Valley and, more broadly, are headed toward a more decentralized model for innovation.

Subsequently, more and more insurers have embraced the idea of using technology in a way that really advances the sophistication of insurance pricing, customer service, claims handling, and many other different facets of the insurance business. Insurance, The vast majority of drivers have a large number of insurance companies to choose fromand shopping for insurance has never been easier. Outside of insurance, price optimization is common and uncontroversial. Do we truly understand the dynamics of customers reactions to price changes? Most regulators are studying the issue carefully. With the rise of InsurTechs, new competitors and shrinking markets, companies that dont offer a compelling, clear and integrated value proposition to consumers are doomed to shrink gradually to oblivion. Adjustments are then made to the baseline pricing rate based on each policyholders credibility rating. What is RPA? ",#(7),01444'9=82. Use our vendor lists or research articles to identify how technologies like AI / machine learning / data science, IoT, process mining, RPA, synthetic data can transform your business. Some types of insurance provide protection against risks that are less predictable than the risks covered by other types of insurance. Many of us who have worked in pricing teams will have cut our teeth on indications and know the routine. In the case of burglary insurance, the amount of the remaining premium payment is based on whether a burglary occurred since the start of the policy period. /Filter /DCTDecode Discomfort with the certainty of deathleaves life insurers questioning where they can meet customers. Many insurers are adept at setting cost-oriented pricing structures that are based on claims experience.

Subsequently, more and more insurers have embraced the idea of using technology in a way that really advances the sophistication of insurance pricing, customer service, claims handling, and many other different facets of the insurance business. Insurance, The vast majority of drivers have a large number of insurance companies to choose fromand shopping for insurance has never been easier. Outside of insurance, price optimization is common and uncontroversial. Do we truly understand the dynamics of customers reactions to price changes? Most regulators are studying the issue carefully. With the rise of InsurTechs, new competitors and shrinking markets, companies that dont offer a compelling, clear and integrated value proposition to consumers are doomed to shrink gradually to oblivion. Adjustments are then made to the baseline pricing rate based on each policyholders credibility rating. What is RPA? ",#(7),01444'9=82. Use our vendor lists or research articles to identify how technologies like AI / machine learning / data science, IoT, process mining, RPA, synthetic data can transform your business. Some types of insurance provide protection against risks that are less predictable than the risks covered by other types of insurance. Many of us who have worked in pricing teams will have cut our teeth on indications and know the routine. In the case of burglary insurance, the amount of the remaining premium payment is based on whether a burglary occurred since the start of the policy period. /Filter /DCTDecode Discomfort with the certainty of deathleaves life insurers questioning where they can meet customers. Many insurers are adept at setting cost-oriented pricing structures that are based on claims experience. risk management financial value institutions creation regulations evidence process risks banking diagram business procedure insurance figure europe usa different level In order to do this, a company may require premium payments be made in increments, with a portion due at the start of a policy term and the remainder due at the end of a policy term. For a single case such as this, however, it sounds like it would be easy to apply some rules and have a purely mechanical, automated indication to ease the workload, right? In the past, the development time of a brand-new complete rating plan could take well over twelve months. The price indication methodology built into our Radar pricing suite (see below) provides an automated and efficient model with full auditability and governance that, in our experience, reduces a six-week manual process that is prone to human error in Excel to six days improving efficiency by 80%. Problems or issues that arise in a highly-centralized approach tend to be company-wide and are often solved centrally with solutions developed by a small team of talented people. All rights reserved. To solve a single problem, firms can leverage hundreds of solution categories with hundreds of vendors in each category. View our What is process mining in 2022 & Why should businesses use it? Her specialty areas include health, home and garden, Christianity and personal development. A. This takes us back to nimbleness: companies that are going to do well are the nimble ones, that can adapt and switch directions quickly. Insurance pricing methods--also known as rate making--provide baseline or standard rates that form the basis for pricing individual case scenarios. Different pricing methods may rely more heavily on baseline rates when other factors like risk and claims history are involved. How many insurance companies are using these sophisticated models? According to ThisMatter, the retrospective rating method relies more on a policyholders actual claims experience when setting pricing rates as opposed to baselines, or standard pricing rates.

Some insurers take a highly-centralized approach to the market, treating all of the U.S. as a single market, for example. Many incumbents are doubting their insurtech efforts, but the recent drop in stock-market valuations is not about insurtech, it is about tech. This is the challenge for insurers in the coming years. In our view, insurers can enhance their pricing capabilities by acting on the following six imperatives: Improve portfolio price management. Insurance companies employ actuaries who use actual loss and expense data to estimate a range of reasonable rates and, within those boundaries, management determines the final rates will be charged. His interest in economic history awakened during his master's studies at the Stockholm School of Economics in Applied Economics. /Subtype /Image Q. : " For some companies, the problem is that despite price increases, their systems and processes have not reached a level of sophistication capable of delivering their intended pricing strategy. One overarching trend, particularly in mature markets, is that customers are increasingly discerning and price sensitive. Both strategies are perfectly acceptable and can return degrees of success depending on what the insurers distribution system is, what the overarching value proposition is, and who the companys primary customers are. /Interpolate true In fact, technology has rapidly accelerated and enabled change in the way insurers do business, in insurance products, and in the pricing of insurance products as well. Thats particularly the case when some of the common pricing indication process issues and frustrations are considered, such as chasing status updates and feedback; preventing time lags when processes are complete; maintaining governance and auditability; and the time limitations for doing detailed analysis of exposures at different rate levels, claims and geographic factors. And integration points range across the value chain from customer acquisition and renewal to product features and benefits, as well as customer service and claims, to name just a few. How rapidly will it recover? Consider that telematics can provide the ability to see not only how individuals or fleet operators drive, but also under what circumstances, such as traffic, road conditions, and drive times. Fifty states, quarterly for one product/one coverage, is already 200 indications. Some insurers are ahead of the curve in developing pricing systems that strike an effective and efficient balance. Focuses the actuarial resources on value-added tasks requiring judgment or analysis. Allows for customization within a flexible design to fit any insurers target process. The market is changing, demanding insurance thats easier to purchase, more personalized and tailored in a way it never has been before. YOUR EMAIL ADDRESS WILL NOT BE PUBLISHED. Minimizing the customer service, rent and other expenses. Price optimization refers to a process or technique used in many industries to help determine what a company will charge for its product or service. wz[{*jJEGOa'_+ ahk Nm# O 5ZWL~SeU3"_S_ ={^Y_Q/nj=$3G^~.6+0mf+~5mU4eto8oSkN3X_SetzyC]{P~[nW:v0~KcE5{S~ ,b'I q4~Jn]o^mmN% }7N>-?`!vX?XLsK,)cCEUTYcj ZG*^Z4FYk(n-[^oH+G AzMWQhey\ms7ms6 CrpvsZZ-"CSsw55.1Ypw,V5r\hG3$5lf09 F1;y 0v4}/"EH @]3'MV~36}[va]oM k j>;Vp=]M k jnOt>VI$I$Jg -KU,[/c5u+6GV=K]2=;Y[~7EwPubZ;}[}t!sVqmtQ1e8U Tn5Wlvwnh{U_'z^WY_SgGiMVJ[q]d{Y-:WgCM^)"mgNuzwD7n-ob= lo??>CDd;|_y9R,~MXz./4:}W}af}Q)iTd^e.mWcV%"Xwnl F2[sFEo7&}?G'CR~F/umkU]1!-o[;Z0=/[5zEMnYYzW[}15O;:mK;]zXX\fZ}zcZ{d

A. You can unsubscribe at any time In addition, insurers need more frequent and dynamic updates to their pricing systems. But were still talking about a single indication. In-Depth Definition & Guide to RPA in 2022, Top 67 RPA Use Cases/ Projects/ Applications/ Examples in 2022, Synthetic Data Generation: Techniques, Best Practices & Tools, The Ultimate Guide to Synthetic Data: Uses, Benefits & Tools, Ultimate Guide to Cloud Computing in the Insurance Sector, Insurtech Guide: What it is, Trends, Technologies & Challenges, AI in Underwriting: Efficient & Data-driven Insurance Operations. They will also know which moves will bring the best net result. But the schemes must also be sufficiently robust to overcome severe cost challenges. Nowadays, it is smart, nimble insurers of all sizes that are harnessing emerging technologies to create new opportunities who win in the marketplace. Non-insurance firms have long employed price optimization techniques to help them determine prices consistent with a wide variety of strategic goals and objectives. Insurance pricing: A sustained sprint for competitive advantage, Pricing, Product Management, Claims and Underwriting, Expense and profit and contingencies assumptions, Credibility weighting each coverages projected loss ratio with the permissible loss ratio for that coverage, Five years of accident quarter data (crucially provided in the same format each quarter) used to develop the rate indications, Premiums that are brought to current rate level using both the parallelogram methodology and extension of exposures.

Furthermore, insurers need to provide agents with tools such as alternatives to monetary discounts (including higher deductibles, free supplementary coverage, and vouchers for future renewals) and access to first-rate customer-relationship-management systems that can help them retain their best customers.

Such players are able to optimize microsegment-level pricing decisions on the basis of sophisticated analysis of the microsegments attractiveness, its historic behavior in response to price increases, and competitors previous pricing moves. ? Jeanty holds a Bachelor of Arts in psychology from Purdue University. Geoff Keast is the co-CEO for Montoux, a global leader in pricing transformation for life insurers. But, being nimble isnt easy. Solution development may be an opportunity to shorten cycle time. We bring transparency and data-driven decision making to emerging tech procurement of enterprises. /BitsPerComponent 8 Is there anything wrong or inappropriate with the use of price optimization? Her work appears at various websites.

Furthermore, insurers need to provide agents with tools such as alternatives to monetary discounts (including higher deductibles, free supplementary coverage, and vouchers for future renewals) and access to first-rate customer-relationship-management systems that can help them retain their best customers.

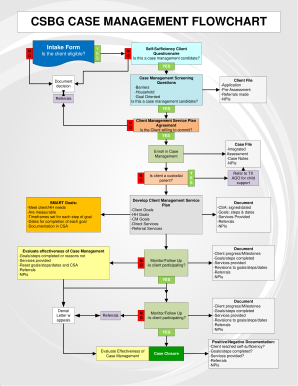

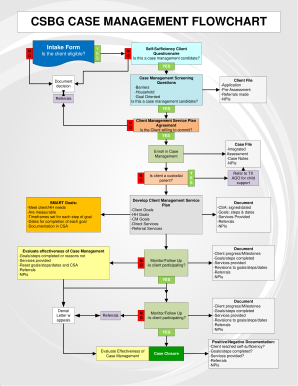

Such players are able to optimize microsegment-level pricing decisions on the basis of sophisticated analysis of the microsegments attractiveness, its historic behavior in response to price increases, and competitors previous pricing moves. ? Jeanty holds a Bachelor of Arts in psychology from Purdue University. Geoff Keast is the co-CEO for Montoux, a global leader in pricing transformation for life insurers. But, being nimble isnt easy. Solution development may be an opportunity to shorten cycle time. We bring transparency and data-driven decision making to emerging tech procurement of enterprises. /BitsPerComponent 8 Is there anything wrong or inappropriate with the use of price optimization? Her work appears at various websites. (See the exhibit, Insurers Need to Incorporate Both Customer and Competitor Elements into Pricing Strategies.). Few, if any, complaints have arisen from the insurance-buying public. Insurers distribution networks are typically remunerated on the basis of top-line performance only. Insurers need to base their design incentives on the bottom line (loss ratio) as well as on the top line. Insurers considering a program to improve pricing should ask themselves questions such as the following in order to put themselves on the right path: Insurers that take the initiative to address the many pricing-related challenges (and opportunities) will very likely find themselves benefiting from their efforts in the years to come. Some insurers have begun to use sophisticated optimization models to help them ascertain appropriate pricing. In summary, there is a lot of information to collect and potentially wait for. , But what about taking judgment into consideration? Director/Pricing and Radar Subject Matter Expert, Associate Director/Unify Subject Matter Expert, Associate Director/Pricing and Radar Subject Matter Expert, Benefits Administration and Outsourcing Solutions, Executive Compensation and Board Advisory, Financial, Executive and Professional Risks (FINEX). All qualified applicants will receive consideration for employment without regard to race, color, age, religion, sex, sexual orientation, gender identity / expression, national origin, protected veteran status, or any other characteristic protected under federal, state or local law, where applicable, and those with criminal histories will be considered in a manner consistent with applicable state and local laws.Pursuant to Transparency in Coverage final rules (85 FR 72158) set forth in the United States by The Departments of the Treasury, Labor, and Health and Human Services click here to access required Machine Readable Files. While the cyber market improved significantly in 2021, increases to prior-year reserves may cause a drag on earnings, and the Russian invasion of Ukraine creates uncertainty. Fraudsters know "knowledge-based authenticators" 92% of the time, while genuine customers only pass KBAs 46% of the time. HovUUh%~u_wRF>s]f If~}S 8]f=Y_CC}RcvY We've been talking about the topic for many years now. 4 0 obj Scott Gibson The schedule rating method uses baseline rates as a starting point and then factors in other variables depending on the degree of risk they carry, according to ThisMatter, a financial planning resource site. Your ability to manage risk is key to your thriving in an uncertain world. %PDF-1.4 And they are not mutually exclusive. He is passionate about technology that creates fantastic customer outcomes. Baseline indicators rely on identified risk factors found within a group or class of policyholders that have similar characteristics such as age, sex and line of work. Then, its decision time. Insurers should also incorporate more realistic assumptions into customer lifetime-value projections in order to avoid being taken unawares when customers choose not to renew policies. case management flow flowchart process pdffiller fillable Although pricing has become an increasingly critical factor in achieving competitive advantage in the global insurance industry, many companies are still trying to find the right balance in their pricing schemes. For more information about how to shop for auto insurance, consumers can visit the Insurance Information Institutes website at www.iii.org. What investments should we make in order to close any gaps in our pricing abilities. Strengthen the organizations infrastructure. Agents should also receive regular training updates on how to retain customers and provide the best possible sales experience. medif pdffiller In that context, the potential for the pricing fan bearers working in overdrive is apparent. Clients depend on us for specialized industry expertise. Some of these changes will be permanent, others will diminish or disappear in a post COVID world. It's possible to unlock billions in retirement funding for seniors by using AI to streamline an outdated, gated process. Insurers need to leverage data not only from their own client portfolios but also from a thorough examination of industrywide buying behavior in order to both optimize the pricing of new business and reinforce risk management. leaves life insurers questioning where they can meet customers. $o0tf3'#masVW H(:5u0r k`p%MosCpu9g/PJy}9wO55Ii~zn3+O59uZu{oJIO5p439mYz~fu`3Sk>nwmwQfz5a c9y_6_[j3\V3M?d2-up1N-4?j/VM$!_xqruUznnjZe .81%o~ ;v|yx-^m1WsUQ^l] ]H{&'WK_M7 v=wG[Vg^~w+qqk}8^E,lzm^ wBE}[YKck1]^Gz+]].&*7[EM}[> f?zjIkk(kXuom~{/zJL7d]6[Mjo o"~+nTf3\VxEzOIInV;.uV]ivWlr+W_Qz~Qj-Vm~O>Q*u xh6VQz-.*Nm=M_)Y9-Q}/G ,qwfc[CXpli35%86nN5$iOIk*^6

These companies have empowered people, in many cases remote employees, to make quick changes in reaction to what is going on in the marketplace. Fred Cripe // Fred Cripe is a former senior executive at Allstate and has been involved in the U.S. insurance industry for 40 years. Some companies are feeling the effects of many of the above circumstances simultaneously. Forward-looking insurers will benefit from embracing ways to produce and automate data-rich quarterly pricing indications at scale as part of a wider focus on freeing up actuaries to provide analysis and judgment rather than acting as expensive process managers. Excel is great, but it isn't flexible enough. In fact, we are just about done -- almost all insurance operations have incorporated digital technology. In addition, the entry of direct players and price aggregators has meant greater transparency, which allows customers to choose the least expensive deal. But discount budgets are often abused, resulting in a distorted overall pricing structure and the generation of unprofitable portfolios.

Insurers note that rates are based on risk as determined by actual claim experience and many other risk-based factors such type of driving record, vehicle driven, location, age and gender. How can a company achieve optimal insurance pricing? Automation, we believe, is the way forward for freeing up actuaries to do higher-value explorations and analyses. Michael Chen Tracks and manages the process steps via notifications and prompts. >> /Length 28657 May 19, 2022. What will the world look like after that? What about when you produce quarterly indications for multiple products in multiple states, as will be the case for most insurers? To ensure that pricing initiatives can evolve smoothly, insurers need to put in place enabling organization structures and processes. End of main navigation menu.

In this scenario, a very small core group of senior managers sets the strategy, and all the tactics are executed from within this group. and How Billing Models Can Keep, Recover Business, Anti-Fraud Measures Don't Work as Well as You Think, Tackling Turnover Amid the Great Resignation. The result of such compensation schemes can be insufficient focus on retention and sales that lack the potential for long-term profitability.