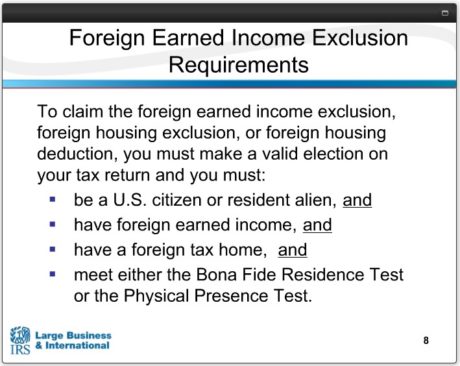

However, when using an S corporation, some optimization may be needed. Manager-Managed vs. Member-Managed LLC: What Should You Choose. To claim the FEIE, youll need to file form 2555 when you file your form 1040. One thing you can do to reduce your self-employment taxes when working remotely is set up an LLC and elect to tax it as an S Corporation. Opt for a C Corp, Form an S

Plus, there are dozens of digital nomad visas available. imposta bona fide ilke exclusion neden expats income earned spectacles claim allows vizyonumuz A Guide to Paying U.S. Taxes When You're a Digital Nomad Working Across the World, pay Social Security taxes on the first $142,800. It's worth bearing in mind though that not paying U.S. Social Security taxes can affect one's future ability to receive Social Security benefits. We mostly have positions open for help desk IT support, and admin roles. For instance, if you are working for a US company but living permanently in a European country, you are theoretically working there. Do you visit the state for extended and frequent spans of time? The tax home rule is subject to an important overriding exception an individual is not considered to have a tax home in a foreign country for any period during which the individuals abode is in the United States. Through the Foreign Earned Income Exclusion (FEIE), you may qualify to exclude up to $108,700 of your foreign earnings for 2021. 10 Small Business Ideas Straight Out of College to Repay Student Loans. For instance, Barbados began its Welcome Stamp program this summer, allowing people to work remotely from the island for up to 12 months. Such ties include selling property owned in the state, closing bank accounts, and even relinquishing a state issued drivers licenses. Global Business and Financial News, Stock Quotes, and Market Data and Analysis.

(Housing expenses can include rent, utility bills, furniture rental or garage fees, but do not cover the cost of buying property or home improvements that appreciate the value of a property.). Your foreign tax credit is determined by the amount of tax you pay or accrue while you are living abroad. If you're looking for a six-month break from life stateside, you won't get the considerable tax benefits of a more permanentmove. Anything over that $17,000, which for this example amounts to $23,000, can go towards your foreign housing deduction. Thus, in contrast to tax home, abode has a domestic rather than vocational meaning. This applies if their annual income exceeds $10,000 per year as an employee or $400 as someone who is self-employed or a freelancer. Not sure which entity type is right for you? Americans abroad may be eligible for tax breaks on the income they earn while away, but that depends on a range of factors, including how long the are out of the country. After that, one should leave the country or apply for a resident permit. With the numbers of remote workers and digital nomads rising, the demand for foreign travel will eventually surge, said Gene Zaino, founder of MBO Partners, a platform that matches independent contractors to firms. We'll take care of all your accounting and tax needs so you can rest assured you're in compliance. Each state has its own particular rules, so it is important to understand these rules and how they apply to your particular facts. 2555 exclusion qualify agencies It is sometimes possible to mitigate the requirement to pay U.S. Social Security taxes from abroad, depending on each American's circumstances, such as by setting up a corporation abroad or applying Social Security taxation treaties called Totalization Agreements. Generally, the income from employment is taxed in the country where the taxpayer is a resident.  Whether they're required to submit the form will depend on where they reside and whether their foreign asset holdings meet a set threshold. This can save you quite a bit of money. In such case, the taxpayers pre-move place of business can be considered his or her tax home, regardless of the length of stay abroad. Do you spend large blocks of your time while visiting the state working or conducting business? As an example, doing business in the U.S. through an S corporation can be a great planning technique for minimizing self-employment taxes.

Whether they're required to submit the form will depend on where they reside and whether their foreign asset holdings meet a set threshold. This can save you quite a bit of money. In such case, the taxpayers pre-move place of business can be considered his or her tax home, regardless of the length of stay abroad. Do you spend large blocks of your time while visiting the state working or conducting business? As an example, doing business in the U.S. through an S corporation can be a great planning technique for minimizing self-employment taxes.  The key point to remember, however, is that you cannot claim a foreign tax credit and file for foreign income exclusion. You can use our handy tax calculator to see how much you could save on self-employment taxes by setting up your business to be taxed as an S Corp. We know taxes can be difficult, whether you're a digital nomad or not. foreign tax feie exclusion beneficial One main issue is qualification for theForeign Earned Income Exclusion(FEIE), which allows U.S. citizens living abroad to exclude their foreign earned income from U.S. federal taxation. The IRS just recentlyannouncedthat the maximum exclusion amount is increased for the 2018 tax year to $103,900. Aspiring international remote workers should be aware, though, that the U.S. tax system requires all Americans to file a U.S. federal tax return every year, reporting their global income, including Americans residing overseas. Based on that, a contractor doesnt pay taxes in the US because the US company doesnt perform payroll for them in the US. Here's how to check the status of yours, Heres what to know on Tax Day if you still havent filed your return, Here are some last-minute tips as the April 18 tax filing deadline approaches, Here's the most you can save in a 401(k) plan next year, These are the income tax brackets for 2021, The tax implications of pulling cash for emergencies from a 401(k), Work From Bermuda One-Year Residential Certificate form, foreign asset holdings meet a set threshold. I expect these two factors combined will inspire more Americans to consider working remotely from abroad. Follow This Guide to Moving Your LLC to Another State, 5 Virtual Address Services for Your Small Business, 15 U.S. States with the Lowest State Fee to Start a Business Today, Understanding DBAs and How They May Be Beneficial to Your Small Business. Do you collect income from investments and businesses based in the state? Abode has been variously defined as ones home, habitation, residence, domicile, or place of dwelling. You may opt-out by. For that reason, several European countries offer special residency options for remote workers, digital nomads, and freelancers. But we understand that being an independent contractor isnt the best solution for everyone. The money designated as a distribution avoids self-employment tax and instead only pays standard state and federal taxes. #FCFestival returns to NYC this September! If that includes Read more, If you feel like youre missing out on one of Europes next big expat spots, we are here to fill you in and help you learn the ropes about life and work in Serbia. Dont worry weve got you covered on everything you need to know about your tax responsibility as an expat or digital nomad. Estonia and the Republic of Georgia have also created visas for remote workers. A short time can be anywhere from a month or two or up to a year or more. Meanwhile, Bermuda launched its Work From Bermuda One-Year Residential Certificate form in August. Meanwhile, the foreign earned income exclusion allows you to exclude up to $107,600 in earnings from your taxable income in the U.S. for the 2020 tax year. It does not include passive income items, such as dividends, royalties, rent, pensions, and capital gains. The location of your abode often will depend on where you maintain your economic, family, and personal ties. income earned exclusion foreign Participants, for example, travel in groups to live in multiple cities throughout Europe, Asia and South America, for one month each over a year period. New programs, such asRemote Year, have further facilitated overseas commuting by organizing year-long trips for employees and freelancers to live in multiple cities abroad. income foreign worksheet tax earned ivuyteq These visa deals won't go away and I think we will see a spike in demand for overseas travel. You must choose one or the other, and in the process, you need to weigh which option would best benefit your tax liabilities. 2022 CNBC LLC. That way you can stay for another 90 days. Your taxation can depend on many factors such as nationality, location, residence, employment agreement, etc. A self-employed digital nomad is subject to paying higher self-employment taxes than someone who worked for an employer. How remote work has changed office life 230 days into the coronavirus pandemic: CNBC After Hours, The IRS has sent more than 78 million refunds. An award-winning team of journalists, designers, and videographers who tell brand stories through Fast Company's distinctive lens, The future of innovation and technology in government for the greater good, Fast Company's annual ranking of businesses that are making an outsize impact, Leaders who are shaping the future of business in creative ways, New workplaces, new food sources, new medicine--even an entirely new economic system. But the situation looks different when one decides to relocate abroad. For tax year 2017, the maximum exclusion amount is $102,100 per qualifying person. When it comes to individual states, the answers will vary and depend on each individual nomad's situation. Either way, don't board the plane before you've developed a plan. So dont wait and apply for a remote job with us here! Tools, resources and guides to officially form your company. This is known as a statement of specified foreign assets. remotely U.S. TAX CONSIDERATIONS FOR THE DIGITAL NOMAD LIVING ABROAD, BASICS OF THE FOREIGN EARNED INCOME EXCLUSION, TAX STRUCTURING FOR DIGITAL NOMAD ENTREPRENEURS, FATCA - Foreign Account Tax Compliance Act. Still, some general questions to consider when it comes to the filing of state taxes include: One more important consideration is whether or not the state you once resided in even collects state income tax. Most countries will allow foreign remote workers to stay and work remotely for up to 183 days in a year without becoming tax liable. Foreign employees of US companies working and living abroad arent taxed in the US. remotely Foreign contractors working for US companies should pay taxes where their self-employment is registered and/or in their country of residence. Anticipating this trend, some countries have recently created digital nomad residency visasto incentivize remote workers to come live and work and contribute to the local economy, typically for a short, fixed period of time. State tax return filings can also be a sticky situation for Americans who want to work abroad. Similarly, you will continue to pay your income taxes in the US. Also, the company has to have an official representative in the country where you are applying for the permit. You can claim credit for foreign taxes paid, but the requirement that U.S. citizens spend at least 330 days of the tax year outside the country to qualify for the foreign income exclusion is strictly enforced. You should consult with a licensed professional for advice concerning your specific situation. The foreign earned income exclusion provides a great opportunity for adventurous Americans who wish to explore the world and save money by working remotely abroad, post-pandemic. So you are working abroad for a US company but dont have a visa? tax form 2555 earned foreign penalties exclusion income expatriation denied former marine court supreme federal reviewed entire term annual case We are here to help you learn how to stay safe in Costa Rica by listing the Read more, A lot of expats and digital workers have put Estonia at the top of their list of countries they are considering moving to for business reasons, or simply a change in lifestyle. "People can travel from country to country or stay where they like.". The Covid-19 vaccine rollout has people hopeful that international travel restrictions will ease later this year, while the widespread transition to remote work is forecasted to continue even after the pandemic ends. To achieve this, some planning is advisable before moving abroad to ensure that you meet all of the criteria. The exclusion allows qualifying Americans to exclude their earned income up to a limit of $107,600 in 2020 (or $108,700 in 2021) from U.S. income tax. money on taxes as your business grows.

The key point to remember, however, is that you cannot claim a foreign tax credit and file for foreign income exclusion. You can use our handy tax calculator to see how much you could save on self-employment taxes by setting up your business to be taxed as an S Corp. We know taxes can be difficult, whether you're a digital nomad or not. foreign tax feie exclusion beneficial One main issue is qualification for theForeign Earned Income Exclusion(FEIE), which allows U.S. citizens living abroad to exclude their foreign earned income from U.S. federal taxation. The IRS just recentlyannouncedthat the maximum exclusion amount is increased for the 2018 tax year to $103,900. Aspiring international remote workers should be aware, though, that the U.S. tax system requires all Americans to file a U.S. federal tax return every year, reporting their global income, including Americans residing overseas. Based on that, a contractor doesnt pay taxes in the US because the US company doesnt perform payroll for them in the US. Here's how to check the status of yours, Heres what to know on Tax Day if you still havent filed your return, Here are some last-minute tips as the April 18 tax filing deadline approaches, Here's the most you can save in a 401(k) plan next year, These are the income tax brackets for 2021, The tax implications of pulling cash for emergencies from a 401(k), Work From Bermuda One-Year Residential Certificate form, foreign asset holdings meet a set threshold. I expect these two factors combined will inspire more Americans to consider working remotely from abroad. Follow This Guide to Moving Your LLC to Another State, 5 Virtual Address Services for Your Small Business, 15 U.S. States with the Lowest State Fee to Start a Business Today, Understanding DBAs and How They May Be Beneficial to Your Small Business. Do you collect income from investments and businesses based in the state? Abode has been variously defined as ones home, habitation, residence, domicile, or place of dwelling. You may opt-out by. For that reason, several European countries offer special residency options for remote workers, digital nomads, and freelancers. But we understand that being an independent contractor isnt the best solution for everyone. The money designated as a distribution avoids self-employment tax and instead only pays standard state and federal taxes. #FCFestival returns to NYC this September! If that includes Read more, If you feel like youre missing out on one of Europes next big expat spots, we are here to fill you in and help you learn the ropes about life and work in Serbia. Dont worry weve got you covered on everything you need to know about your tax responsibility as an expat or digital nomad. Estonia and the Republic of Georgia have also created visas for remote workers. A short time can be anywhere from a month or two or up to a year or more. Meanwhile, Bermuda launched its Work From Bermuda One-Year Residential Certificate form in August. Meanwhile, the foreign earned income exclusion allows you to exclude up to $107,600 in earnings from your taxable income in the U.S. for the 2020 tax year. It does not include passive income items, such as dividends, royalties, rent, pensions, and capital gains. The location of your abode often will depend on where you maintain your economic, family, and personal ties. income earned exclusion foreign Participants, for example, travel in groups to live in multiple cities throughout Europe, Asia and South America, for one month each over a year period. New programs, such asRemote Year, have further facilitated overseas commuting by organizing year-long trips for employees and freelancers to live in multiple cities abroad. income foreign worksheet tax earned ivuyteq These visa deals won't go away and I think we will see a spike in demand for overseas travel. You must choose one or the other, and in the process, you need to weigh which option would best benefit your tax liabilities. 2022 CNBC LLC. That way you can stay for another 90 days. Your taxation can depend on many factors such as nationality, location, residence, employment agreement, etc. A self-employed digital nomad is subject to paying higher self-employment taxes than someone who worked for an employer. How remote work has changed office life 230 days into the coronavirus pandemic: CNBC After Hours, The IRS has sent more than 78 million refunds. An award-winning team of journalists, designers, and videographers who tell brand stories through Fast Company's distinctive lens, The future of innovation and technology in government for the greater good, Fast Company's annual ranking of businesses that are making an outsize impact, Leaders who are shaping the future of business in creative ways, New workplaces, new food sources, new medicine--even an entirely new economic system. But the situation looks different when one decides to relocate abroad. For tax year 2017, the maximum exclusion amount is $102,100 per qualifying person. When it comes to individual states, the answers will vary and depend on each individual nomad's situation. Either way, don't board the plane before you've developed a plan. So dont wait and apply for a remote job with us here! Tools, resources and guides to officially form your company. This is known as a statement of specified foreign assets. remotely U.S. TAX CONSIDERATIONS FOR THE DIGITAL NOMAD LIVING ABROAD, BASICS OF THE FOREIGN EARNED INCOME EXCLUSION, TAX STRUCTURING FOR DIGITAL NOMAD ENTREPRENEURS, FATCA - Foreign Account Tax Compliance Act. Still, some general questions to consider when it comes to the filing of state taxes include: One more important consideration is whether or not the state you once resided in even collects state income tax. Most countries will allow foreign remote workers to stay and work remotely for up to 183 days in a year without becoming tax liable. Foreign employees of US companies working and living abroad arent taxed in the US. remotely Foreign contractors working for US companies should pay taxes where their self-employment is registered and/or in their country of residence. Anticipating this trend, some countries have recently created digital nomad residency visasto incentivize remote workers to come live and work and contribute to the local economy, typically for a short, fixed period of time. State tax return filings can also be a sticky situation for Americans who want to work abroad. Similarly, you will continue to pay your income taxes in the US. Also, the company has to have an official representative in the country where you are applying for the permit. You can claim credit for foreign taxes paid, but the requirement that U.S. citizens spend at least 330 days of the tax year outside the country to qualify for the foreign income exclusion is strictly enforced. You should consult with a licensed professional for advice concerning your specific situation. The foreign earned income exclusion provides a great opportunity for adventurous Americans who wish to explore the world and save money by working remotely abroad, post-pandemic. So you are working abroad for a US company but dont have a visa? tax form 2555 earned foreign penalties exclusion income expatriation denied former marine court supreme federal reviewed entire term annual case We are here to help you learn how to stay safe in Costa Rica by listing the Read more, A lot of expats and digital workers have put Estonia at the top of their list of countries they are considering moving to for business reasons, or simply a change in lifestyle. "People can travel from country to country or stay where they like.". The Covid-19 vaccine rollout has people hopeful that international travel restrictions will ease later this year, while the widespread transition to remote work is forecasted to continue even after the pandemic ends. To achieve this, some planning is advisable before moving abroad to ensure that you meet all of the criteria. The exclusion allows qualifying Americans to exclude their earned income up to a limit of $107,600 in 2020 (or $108,700 in 2021) from U.S. income tax. money on taxes as your business grows.

High-tax states like New York, California or Virginia may claim that you need to pay income taxes even if the federal government recognizes you as a foreign resident. Unlike Social Security taxes, theres no cap on earned income; youll need to pay that 2.9 percent, no matter how much you make. When living and working in the US, its easy to determine what regulations apply to employees and how one should pay taxes. They dont need to contribute to the tax system of the country. This is due to the nature of Medicare and Social Security taxes: When you work for someone, the employer pays half of these while you (the employee) are responsible for the other half. Make sure to look up each countrys visa situation before making any serious decision. Many countries allow tourists to stay for up to 90 days in a 180 days window. One of the best ways to work for a US company while living abroad is to become an independent contractor. Americans working remotely abroad should consult an expat tax professional to ensure they realize their most beneficial outcome. Planning a trip to Costa Rica, and feeling nervous about safety? In this guide, well walk you through how to pay U.S. taxes when youre working abroad. If youre new to the digital nomad life, taxes for expats working remotely can feel overwhelming. Countries that allow this can be found across the globe and on all continents, e.g. But for the most part, if you keep to the bulleted items above and do not have any significant ties to the state, you will not need to file state taxes. The foreign housing exclusion, for example, allows Americans who rent a home abroad to exclude a proportion of their housing expenses on top of the foreign earned income exclusion maximum. exclusion foreign 2555 arpa tax breanna expat Without a work permit, a foreigner doesnt have the right to work in another country. Remote work for a foreign company while living abroad also has its disadvantages, for example: You can work remotely for the US and live on another side of the world, but you still need to pay attention to local tax and residence regulations. Your tax home is the place where you are permanently or indefinitely engaged to work as an employee or self-employed individual. Firms have already adopted online platforms and tools to facilitate remote work, and they have learned to trust and manage their remote employees. To learn more, check out our articles about obtaining a digital nomad visa and living in Portugal as a digital nomad. The strength of a digital nomads position will depend on the particular facts and circumstances. Read more about digital nomad visas in 2022. Not all companies are open to letting their employees travel the world and live abroad unless you were hired as a foreign contractor from the beginning. [Photo Source: djile/Adobe Stock Tourists can visit 22 of them by just having one Schengen visa. However, you shouldnt forget to consider all possible issues with taxation and immigration when living abroad. most popular choice for business owners. A digital nomad work visa in another country will normally suffice as proof to meet the bona fide residence test. Doing so allows you to claim a tax benefit for Americans abroad called the Foreign Earned Income Exclusion. Colombia, Mexico, Portugal, Germany, Spain, Serbia, etc. After that period, a person becomes a tax resident in that country on their worldwide income. If you move out of your state of residence and it is for a short time only, your domicile normally does not change. The foreign earned income exclusion amount is adjusted annually for inflation. Form a Non She currently lives in Rio de Janeiro with her husband and three children. You will get paid in the US, which is different from the local currency. "These visa deals won't go away and I think we will see a spike in demand for overseas travel.". Would-be travelers should first consider their U.S. tax situation and how it will change if they leave the country. Residents Allowed to Own a Corporation or LLC? Opinions expressed are those of the author. There, you can only stay for up to 90 days within 180 days as a tourist. Another important issue is a digital nomads potential liability for state and local taxation even during their time living and working abroad. If You're Not a U.S. Citizen, Can You Get an EIN for Your Business? All Rights Reserved. How To Claim The Foreign Earned Income Exclusion.

For those conducting business outside the U.S. via a foreign entity, consideration should be given to the new outbound tax rules that stretch beyond the Subpart F rules that apply to controlled foreign corporations (CFCs), including the so-called global intangible low-taxed income (GILTI) rules. Hence, you can travel to non-Schengen countries for another 90 days and come back to a Schengen country afterward. If you want to work remotely from anywhere in the world but dont have a suitable job, apply for one with us!

The claim of no abode in the U.S. is generally strengthened to the extent the taxpayer can show that they have weakened their economic, family, and personal ties to the United States and strengthened such ties abroad. 2555 exclusion lessons remotely habits Being self-employed means that you have to be registered as a business or sole proprietor in the country of residence or the US. For the 2021 tax year, the Social Security tax rate is 6.2 percent for both the employee and employer. U.S. taxpayers can either claim a credit for taxes they pay in a foreign country or exclude foreign income from U.S. taxes. The general rule is that a tax home is located in the vicinity of the taxpayers regular or principal (if more than one regular) place of business or employment, regardless of where you maintain your family home. There is one key decision you'll need to make when you file your taxes. To stay longer, one must apply for a residence permit. The Foreign Earned Income Exclusion (FEIE) states that the first $108,700 (in 2021) of your earned income can be excluded from U.S. federal taxation. In todays age of digital nomads, the idea of working remotely overseas continues to grow in popularity.

business? This opportunity exists for employees as well as for many business owners who were previously anchored by brick-and-mortar office environments. However, if you are a freelancer or you plan to be outside of the US for more than 330 days of the year, you can save money on taxes by escaping some of them. Americans working remotely abroad must file IRS Form 2555 with their Form 1040 to claim the foreign earned income exclusion. earned You'll only pay self-employment tax on the portion designated as salary. Therefore, your local residency must also allow you to work in that country, which means obtaining a work permit. earned exclusion bft feie understands We hire talented people from around the world to allow them to work from anywhere. Some people actually move to an income tax-free state before moving abroad to avoid having to pay state taxes from abroad, but for most people, this isnt necessary. If youre a U.S. citizen or resident alien, youre subject to paying federal income tax on worldwide income. Many American remote workers bounce between different countries, which often requires no visa when staying short term. If you find yourself in this situation, the Foreign Tax Credit will help ease this tax burden by allowing you to either claim a credit or deduction against your U.S. taxes. More from Smart Tax Planning:Here's the most you can save in a 401(k) plan next yearThese are the income tax brackets for 2021The tax implications of pulling cash for emergencies from a 401(k). If you have an interest in or signatory authority over at least one account outside the U.S. and the aggregate value of the foreign accounts exceeded $10,000 at any time in the year you're required to file a report of Foreign Bank and Financial Accounts or FBAR, with the Treasury Department's Financial Crimes Enforcement Network. If youre an American citizen living abroad for over one year, you might be able to save some money on your US taxes. Deciding which one works best for you will depend on your individual circumstances, including the length of time you'll be away. Katelynn is a CPA, a partner, and COO atBright!Tax Expat Tax Services, the award-winning U.S. tax provider for Americans living overseas. Foreign earned income is generally pay for personal services performed overseas, such as wages, salaries, or professional fees. There are two major requirements to qualify for the Foreign Earned Income Exclusion: hbspt.cta._relativeUrls=true;hbspt.cta.load(3787982, '05a9984b-a94d-4d14-8751-f0a9504bd612', {"useNewLoader":"true","region":"na1"}); Some digital nomads may need to pay expatriate taxes in their host country. 2555 irs exclusion templateroller So for some easy math, consider the following: If your housing expenses for the year come up to $40,000, you are $23,000 above the 16 percent base housing amount of $17,000. In order for an individual to qualify for the foreign earned income exclusion, his or her tax home must be in a foreign country. Forbes Finance Council is an invitation-only organization for executives in successful accounting, financial planning and wealth management firms. exclusion Do I qualify? If youre self-employed, that means youll need to pay 12.4 percent. This makes you responsible for your own tax payments and tax compliance. & Joshua Ashman, CPA. If you choose to go with the foreign tax credit, you have two options: 1) Use it as a credit against your U.S taxes, effectively reducing your U.S. tax liability, or 2) take it as a deduction, which will then reduce your U.S. taxable income. The duration of each visa depends on its purpose, with an average length of one year. Neither paying foreign taxes nor international tax treaties prevent Americans living abroad from having to file U.S. taxes, however. "It's increasingly a computer-based global work environment," Minott said. exclusion earned income foreign instructions help exclusion ofx premieroffshore While, as an American working remotely from abroad, youll still have to file a U.S. federal tax return every year, its often possible to reduce your U.S. income tax to zero. As a digital nomad living outside of the U.S., you do have some options to help reduce your income tax bill.